GRANTS, LOANS, INCENTIVES AND CREDITS

(GLICs)

MOST BUSINESSES CANNOT KEEP UP WITH ALL THE GOVERNMENT INCENTIVES AVAILABLE THESE DAYS.

Many of these incentives are millions of dollars in size. I work on a success fee basis. Let me help you identify which incentives apply, and then I can write the documentation for you. For example, just the Inflation Reduction Act includes the 45X, the 48C, USDA REAP, 179D, and various commercial benefits. The DOE has its own set of grants and loans, etc.

Renewable Rob is a USA native chemical engineer (LSU) who specializes in both identifying and writing Renewable Energy Grants, Loans, Incentives & Credits (GLICs) for small businesses, municipalities, and farms throughout America.

With the advent of more funding from the Department of Energy (DOE) he specializes in finding the right incentive for almost any company from multiple governmental agencies.

For exaxmple, just the list of just DOE grants is huge… click here

His writing is of professional technical quality from a native English speaking engineer. A number of his services are described below. If you do not see the grant or incentive that you are interested in, please get in touch.

For more information please call 213.500.7236 (ET-Jupiter, South Florida) or email Rob@RobertMerrillFletcher.com.

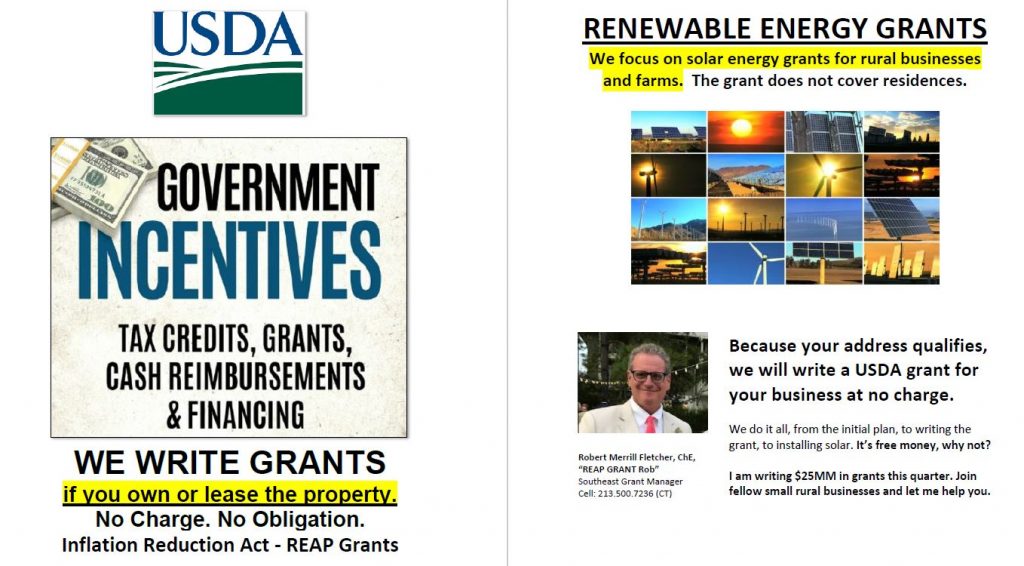

USDA REAP GRANT

WRITING SPECIAL $2995

Fixed Price; Two Week Turnaround; Guaranteed.

NEPA ENVIRONMENTAL

REPORT WRITING;

USDA Categorical Exceptions for Solar; Historical Building Reports; All Environmental Reports; Professional Engineers.

Fast Turnaround If Your Grant is Being Held Up.

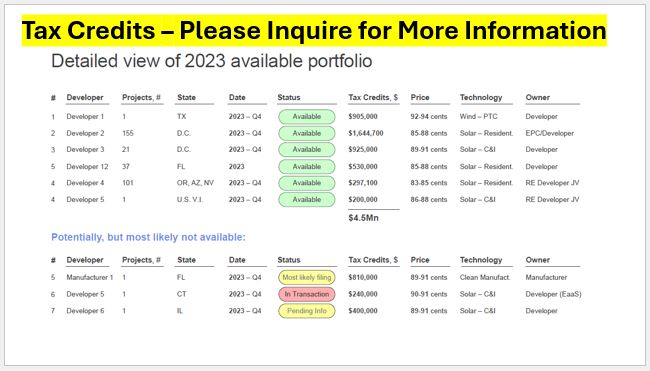

RENEWABLE ENERGY TAX CREDITS BUY/SELL

Mr. Fletcher also buys and sells renewable energy tax credits. If you wish to buy or sell renewable tax credits please get in touch.

For a list of currently available tax credits click here.

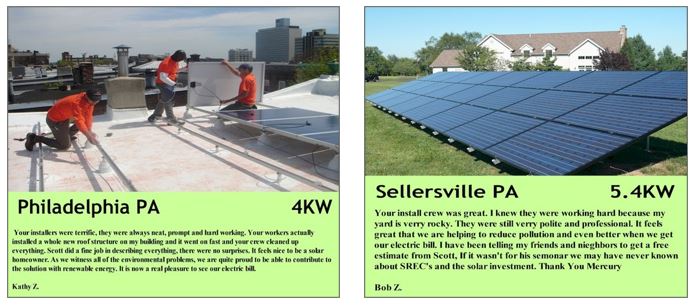

Mr. Fletcher, the founder of RMF Renewable Energy Consulting Group, also designs and implements solar projects around the country with a team of professional engineers, LEED certified energy efficiency experts, and local trade professionals.

“The Rural Energy for America Program (REAP) grant from the USDA is an amazing and free way to add solar electricity to your business”, states Mr. Fletcher. Please contact Rob@RobertMerrillFletcher.com or call 213 500 7236 (ET) for more information. (We do not service residential accounts).

Your business can receive a grant for a solar system like this rural business did.

Click here to see the USDA Reap Grant Presentation and Overview

Renewable Rob is also working on a Solar Net Zero Building Unit that can be used for off-grid storage, camping, glamping, RV parking, and tiny homes:

https://robertmerrillfletcher.com/wp-content/uploads/2024/04/SDZU-renderings.pdf

Please contact us to discuss how we can bring these amazing concepts and programs to your business or municipality.